Did you know you can form a U.S. LLC without ever stepping foot in the U.S.? In fact, thousands of Indian founders have already taken this route to expand their startups, SaaS products, agencies and e-commerce ventures globally.

Why? Because a U.S. LLC provides strong legal protection and tax benefits, along with easier access to U.S. investors and customers.

In this guide, you’ll learn exactly how to complete LLC registration in USA from India. Let’s dive in!

What is an LLC and Why Choose It?

An LLC (Limited Liability Company) is a business structure in the United States that combines the legal protection of a corporation with the simplicity of a sole proprietorship.

Key benefits for Indian entrepreneurs include:

-

- Limited liability protection.

- Flexibility in management.

- Global credibility for customers and investors.

- Easier to integrate with U.S. payment gateways (Stripe, PayPal, Amazon FBA).

By choosing LLC company registration in the USA, founders gain both protection and credibility for international expansion. To protect your intellectual property and startup assets abroad, explore our Startup Intellectual Property Protection Guide.

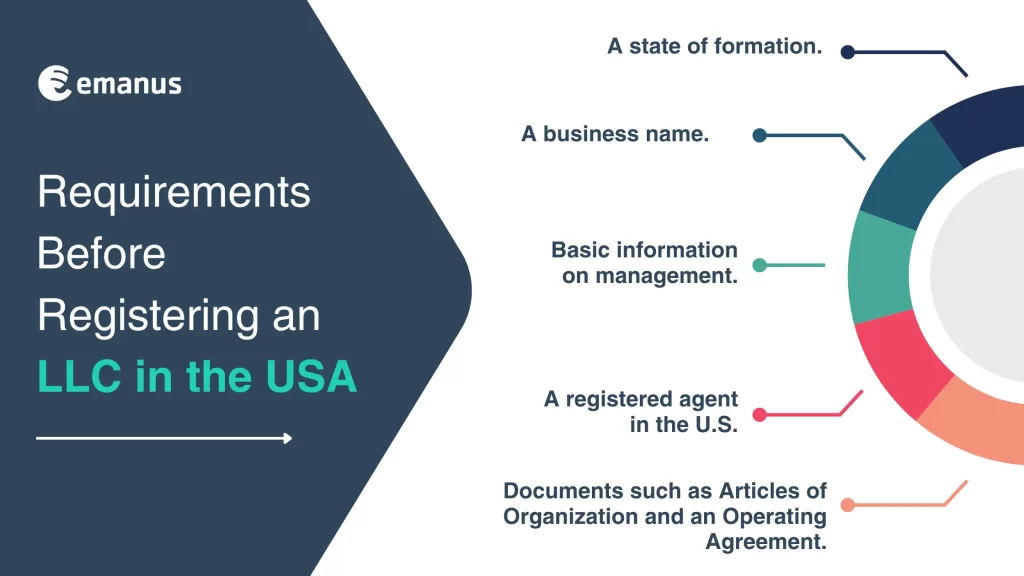

Requirements Before Registering an LLC

For LLC registration, you need:

- A state of formation.

- A business name.

- A registered agent in the U.S.

- Basic information on management.

- Documents such as Articles of Organization and an Operating Agreement.

Step-by-Step Process to Form an LLC

1. Select the State of Formation

You can technically form an LLC in any of the 50 states, but most non-resident founders choose Delaware or Wyoming because of their business-friendly laws and low taxes.

Rule of thumb: If you’ll have a physical office or employees in a specific state, register there. Otherwise, Delaware or Wyoming are great picks. If you’re setting up your LLC for U.S. clients or investors, review how the DTAA Between India and USA can help you avoid double taxation on cross-border income.

2. Pick a Business Name

Your LLC name must:

- Include “LLC,” “L.L.C.,” or “Limited Liability Company.”

- Avoid words linked to government agencies (e.g., FBI, Treasury).

- Avoid restricted terms like Bank, University, or Attorney (unless licensed).

Steps to finalize your name:

-

- Check availability on your chosen state’s website.

- Search the U.S. Trademark Electronic Search System (USPTO).

- Secure a matching domain name.

(Optional) Reserve the name for up to 120 days (Delaware: $75, Wyoming: $50).

3. Nominate a Registered Agent

- Every LLC company registration in the USA requires a registered agent with a U.S. address.

- Costs range between $150–$300 annually.

4. Choose LLC Management

You can set up your LLC as either:

- Member-Managed: All owners actively run the business

- Manager-Managed: One or more managers handle operations, while other members act as investors.

5. File Articles of Organization

- This is the legal birth certificate of your LLC.

- Filing this document officially completes your LLC registration in USA. Once your company is registered, consider using Product Mapping to identify potential patent overlaps and safeguard your innovations.

6. Draft an Operating Agreement

It defines:

- Ownership structure

- Profit/loss distribution

- Roles of members/managers

- Voting rights

- Dissolution procedures

Banks and investors often ask for this, so keep one prepared.

7. Apply for EIN (Employer Identification Number)

An EIN is like your business’s Social Security Number, issued by the IRS.

You’ll need it to:

- Open a U.S. bank account

- File taxes

- Use payment platforms (Stripe, PayPal, Amazon FBA)

Process for Indian founders:

-

- Fill Form SS-4 and fax/mail it to the IRS (since non-residents can’t apply online).

- Provide your LLC approval documents.

- Wait 4–6 weeks for confirmation (mailed to your U.S. address or forwarded).

LLC Registration Fees in USA

One-time costs:

- Business name reservation: $50–$75

- State filing fees: $90–$100

Annual costs:

- Registered agent: $150–$300

- Franchise tax (Delaware: $300; Wyoming: $50)

- Mail forwarding: $100–$200

Common Mistakes to Avoid

- Choosing the wrong state.

- Not appointing a proper registered agent.

- Skipping the operating agreement.

- Mixing personal and business funds.

- Ignoring annual compliance reports.

FAQs

- How to register an LLC by myself in the USA?

Pick a state, choose a business name, hire a registered agent, file Articles of Organization and apply for an EIN. - Can Indians open an LLC in the USA?

Yes! Many Indian founders have U.S. LLCs. LLC registration in the USA from India can be done without visiting the U.S. - Can a non-U.S. citizen create an LLC?

Absolutely. The U.S. allows both residents and non-residents to form LLCs. The entire LLC registration in the USA process can be done remotely. - Is a U.S. LLC tax free?

Not fully. Federal taxes apply, but some states like Delaware and Wyoming don’t charge state income tax for non-residents. - Can I get a visa if I have an LLC in the USA?

No, simply owning an LLC doesn’t give you a U.S. visa. But if your business grows, you may later apply for work or investor visas through other programs. - How much does it cost to open an LLC in the USA?

Expect around $150–$300 upfront and $150–$300 yearly. That’s your total LLC registration fee in the USA.

Conclusion

Forming a U.S. LLC from India is straightforward, affordable, and a smart move for entrepreneurs targeting global markets. With the right state, a good registered agent and proper compliance, you can unlock U.S. business opportunities without leaving India.

Whether you’re running a SaaS, creative agency, or e-commerce store, setting up a U.S. LLC can give your business credibility, easier banking access, and tax efficiency.

Don’t let borders limit your business. With Emanus, forming a U.S. LLC from India has never been easier—get started now!